wichita ks sales tax calculator

The average cumulative sales tax rate between all of them is 85. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Downtown.

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

The minimum combined 2022 sales tax rate for Wichita Kansas is.

. Your household income location filing status and number of personal. Due to high call volume call agents cannot check the status of your application. Released Ahead of the IRS Official Figures.

The December 2020 total local sales tax rate was also 7500. There are also local taxes up to 1 which will vary depending on region. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr.

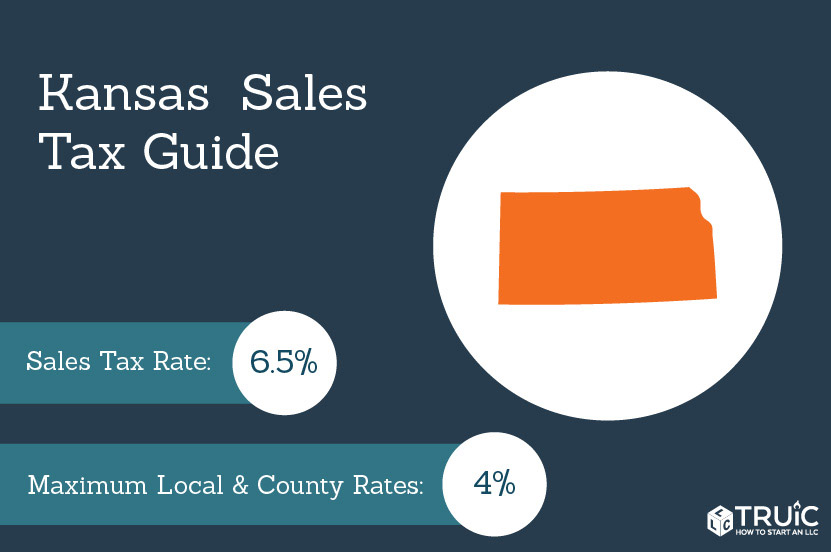

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. Real property tax on median.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 755 in Sedgwick County Kansas. What is the sales tax rate in Wichita Kansas. The Wichita Kansas sales tax rate of 75 applies to the following 28 zip codes.

3 beds 2 baths 1967 sq. Use Walser Auto Campuss payment calculator to easily estimate and compare monthly payments on your next vehicle purchase. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Jump-Start Your Tax Planning. Modernization Fee is 400.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. A full list of these can be found below. Title and Tag Fee is 1050.

In addition to taxes car. Coalfire systems inc apple iphone 8 plus detailsTo calculate the portion of the proceeds that is sales tax use. Wichita Kansas and Kansas City Kansas.

The sales tax rate for Wichita County was updated for the 2020 tax year this is the current sales tax rate we are using in the. The current total local sales tax rate in Wichita KS is 7500. Kansas has a 65 statewide sales tax rate but.

Sales Tax State Local Sales Tax on Food. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local. 2022 Cost of Living Calculator for Taxes.

This is the total of state county and city sales tax rates. The most populous location in Wichita County Kansas is Leoti. Tax credits itemized deductions and.

If youre an online business you can connect TaxJar directly to your shopping cart and. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Wichita KS. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Tax title license registration lien fee and. Jump-Start Your Tax Planning. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000.

Sales tax in Wichita County Kansas is currently 85. Ad Comprehensive Reporting for Accurate Planning and Compliance. Released Ahead of the IRS Official Figures.

The sales tax rate. You can find more. View sales history tax history home value estimates and overhead views.

Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your.

Ad Comprehensive Reporting for Accurate Planning and Compliance. Ad Our tax preparers will ensure that your tax returns are complete accurate and on time. Avalara provides supported pre-built integration.

House located at 2044 W Savannah St Wichita KS 67217.

Texas Sales Tax Calculator Reverse Sales Dremployee

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

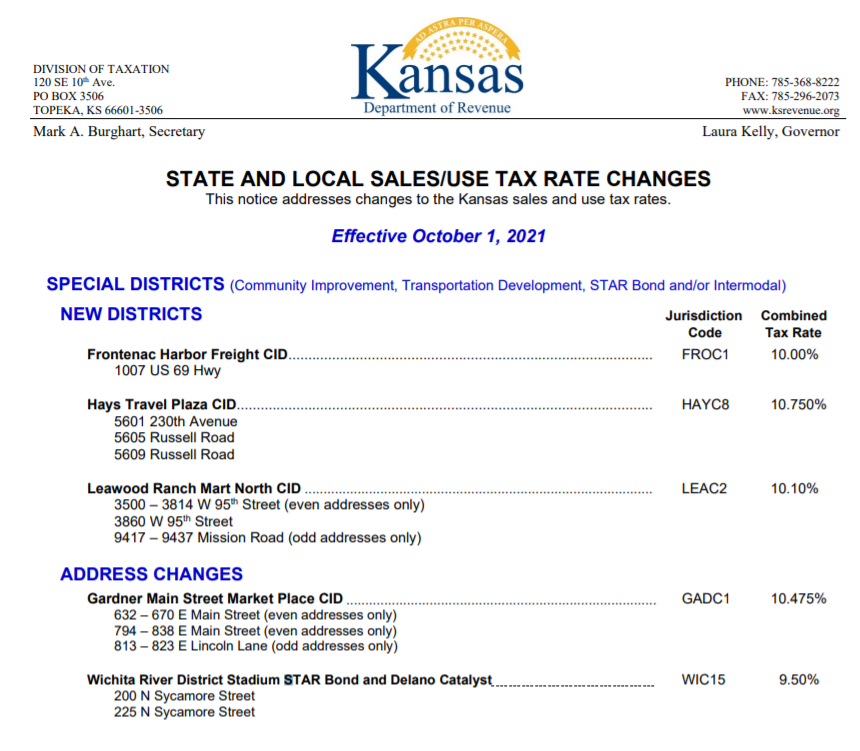

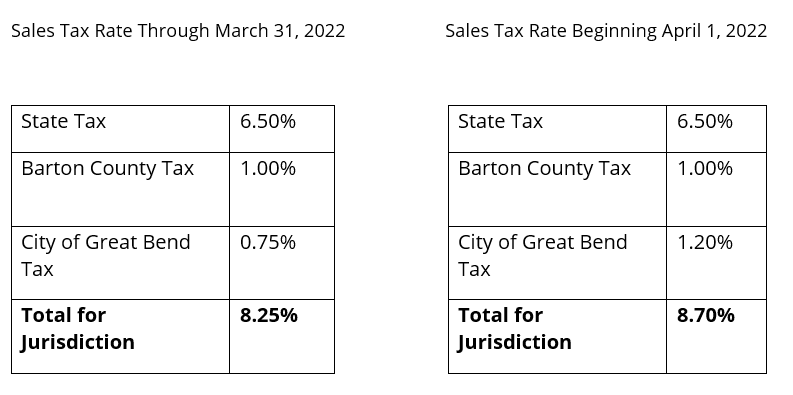

Great Bend Ellinwood Kansas Sales Tax Increases On April 1 2022 Adams Brown

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Kansas Income Tax Calculator Smartasset

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

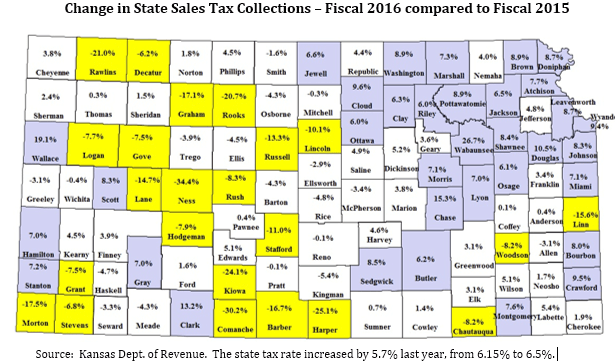

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute

Sales Tax On Grocery Items Taxjar

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Kansas Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

Sales Tax Rate Changes Take Effect Jan 1 In Oklahoma City Kokh